The background: IEA and its fellow petitioners brought the lawsuit to the Supreme Court to challenge the constitutionality of House Bill 93, which established a tax credit of up to $7,500 per student for private school expenses.

• The petitioners sought a writ of prohibition to stop the Idaho Tax Commission, which administers the vouchers, to stop the agency from implementing the law. Parents began applying for the private school tuition subsidy just last month.

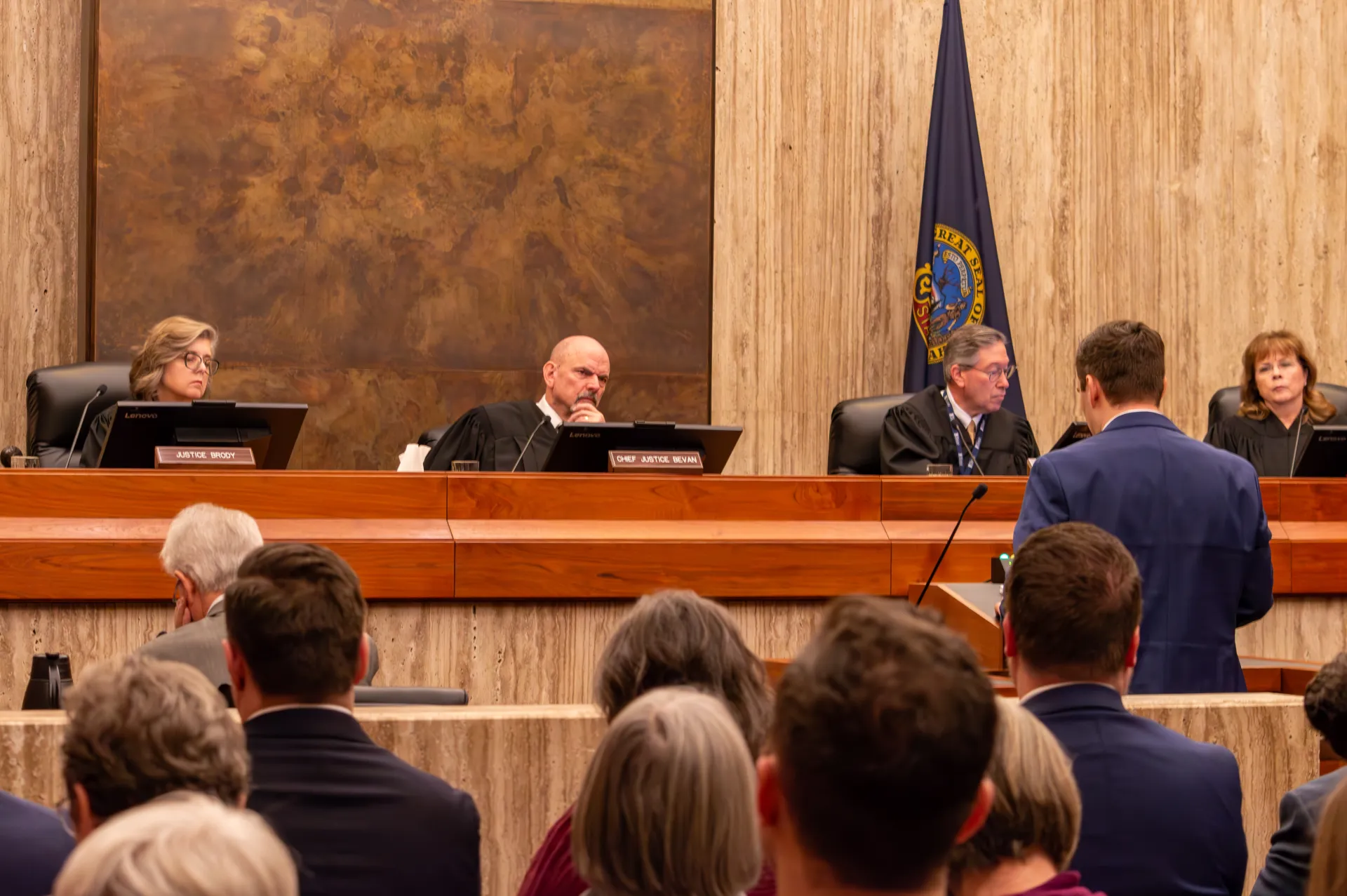

The rationale: On Thursday, the Idaho Supreme Court gave several reasons why the law will stand as written.

• Petitioners lack standing. The Supreme Court’s ruling states that none of the petitioners has an “injury in fact.” In other words, the Court does not believe any of the petitioners have been harmed by the law. However, Justice Gregory Moeller authored a special concurrence discussing the importance of the issue at hand and mentioned that “[t]he Petitioners’ injury claims are currently hypothetical and speculative; yet they may be reexamined in the future when the impact of this legislation can be properly ascertained.”

• Constitutional interpretation. The Court ruled that the petitioners have not shown how the law conflicts with the text of the Idaho Constitution. In other words, the creation of “a general, uniform and thorough system” of public schools — as laid out in the state’s founding document — does not preclude the Legislature from creating another.

• Or, put concisely: The Court found that the Legislature has the power to create tax credits for private education, HB 93 is constitutional, and the Idaho Constitution does not restrict the Legislature from creating education options beyond public school.

What IEA is saying: “This is not the ruling we were hoping for,” said IEA Executive Director Paul Stark. “We appreciate the Court’s careful attention to the lawsuit and the opportunity to argue for public education. But it is profoundly disappointing that we must wait for damage to be done to Idaho’s public school system before vouchers can be challenged again in the courts. Idaho’s public school students, educators, and the communities that must foot the bill for the voucher program — while struggling mightily to maintain their own underfunded schools — will pay the true cost of HB 93. In the meantime, the power to make public education better is well within our reach. We must take it by turning out to vote in the May primary. This setback can be temporary — but only if we all express our displeasure in the system at the ballot box.”

You can prevent more bad laws

Register to vote in the May primary and help your fellow members elect a pro-public education majority to the Idaho Legislature.