Legislation creating a tax credit voucher in Idaho was rejected by the House Revenue and Taxation Committee in a 10-7 vote on Tuesday.

House Bill 447, which would have offered tax credits to pay for private school tuition, was unveiled for Idahoans with great fanfare just before the start of the 2024 legislative session. Yet, the bill, introduced in the House Revenue and Taxation Committee on Jan. 30, languished on the committee’s reading calendars for six weeks because of its co-sponsors’ inability to convince enough members to endorse it.

Idaho Education Association members have long opposed vouchers — or siphoning public tax dollars away from public schools to pay for private or parochial school tuition — in any form. House Bill 447 was no different with IEA members sending more than 6,500 emails to committee members opposing the bill since its introduction.

SAY ‘THANK YOU’ TO THE TEN LAWMAKERS WHO STOPPED THIS TAX CREDIT VOUCHER

The bill was sponsored by Reps. Wendy Horman (R-Idaho Falls) and Jason Monks (R-Meridian) and Sens. Scott Grow (R-Eagle) and Doug Ricks (R-Rexburg). It would have allowed private school families of any income to claim $5,000 tax credits for tuition, fees, transportation, tutoring and other expenses. Families with a learning-disabled student could have claimed an additional $2,500.

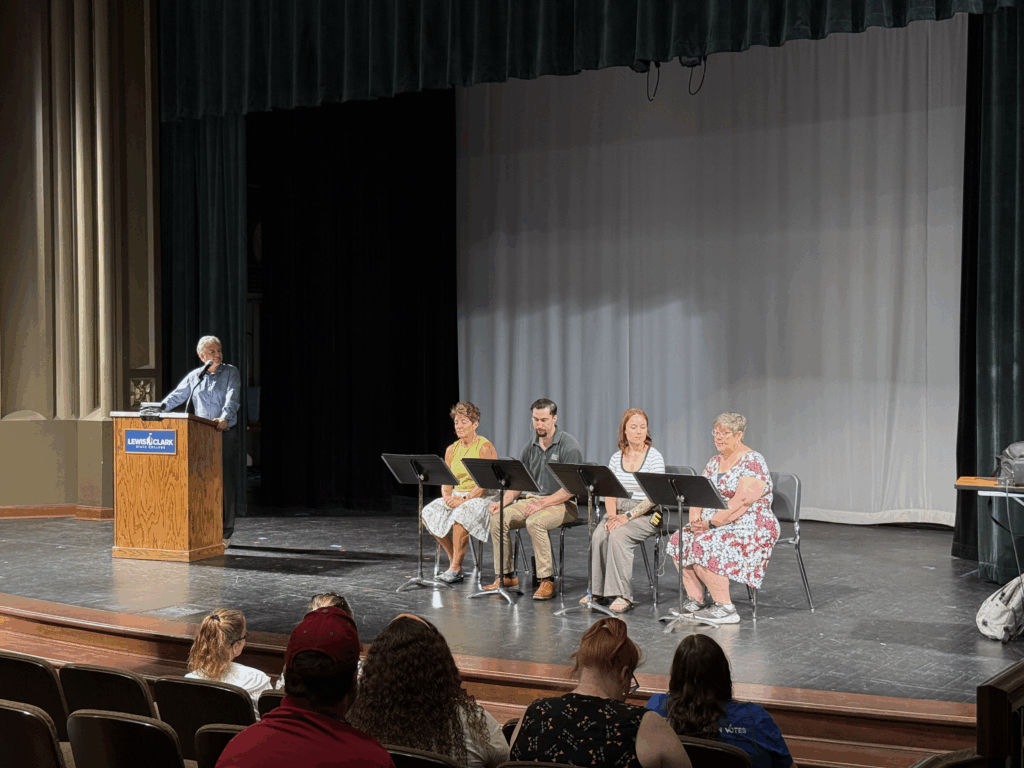

Tuesday’s two-hour-plus hearing was tense at times with voucher advocates, including national voucher lobbyists, parents and sponsors, giving passionate testimony in favor of the bill.

Despite that, the committee rejected the bill.

Rep. Kenny Wroten (R-Nampa) pointed out that the legislation left rural taxpayers to subsidize private education in urban areas, where private schools are concentrated.

“We already have nationally recognized school choice,” he said. “This, to me, just seems like it will be the camel’s nose under the tent.”

LEARN MORE ABOUT IEA MEMBERS’ OPPOSITION TO VOUCHERS

In his testimony against the bill Tuesday, West Ada Education Association President Zach Borman evoked this school district’s historic $500 million plant facilities levy that failed last summer. West Ada School District is dealing with one of the nation’s fastest growth rates, which is outstripping the district’s ability to keep up with facilities and other needs.

“As I’m sure you know, the levy failed pretty miserably, not because residents didn’t agree with the need, but because they are tired of having to disproportionately foot the bill for the Idaho Legislature’s constitutional responsibilities,” Borman told the committee.

Chris Parri, IEA’s political director, pointed to a voter poll commissioned by IEA in the fall. The results showed a majority of likely Idaho voters oppose directing public tax dollars to private K-12 schools, while 80% believe schools benefiting from vouchers, if ever enacted in Idaho, should meet the same accountability and transparency standards as public schools.

House Bill 407 did not meet those expectations, Parri said.

“More broadly, no voucher bill passed anywhere in the country has met that level of accountability or transparency,” Parri said. “The lack of accountability prevents taxpayers from having any insight or assurance that their tax dollars are actually being used to provide a quality education to Idaho kids. The lack of transparency prevents parents from having any insight into how their child might be treated in a private school.”

CLICK HERE TO WATCH TUESDAY’S COMMITTEE HEARING

IEA’s opposition to vouchers is one of the key reasons Idaho remains one of the few states dominated politically by conservatives without voucher programs of some type. That has made it a target for national voucher proponents eager to bring these taxpayer-funded government subsidies for private schools and private school vendors to as many states as possible.

Quinn Perry, deputy director of the Idaho School Boards Association, listed off several states — Utah, Arizona, Illinois, Ohio, Wisconsin, and Florida — that have enacted voucher schemes that have become budget-busters.

“Every ESA (education savings account) tax credit or voucher-like program has ballooned into a multimillion-dollar program handed out without accountability or transparency,” Perry said.

Here’s how the committee voted on House Bill 447:

In support:

- House Majority Leader Jason Monks (R-Meridian)

- House Assistant Majority Leader Sage Dixon (R-Ponderay)

- Revenue and Taxation Committee Chair David Cannon (R-Blackfoot)

- Revenue and Taxation Committee Vice Chair Jeff Ehlers (R-Meridian)

- Rep. Charlie Shepherd (R-Pollock)

- Rep. Douglas Pickett (R-Oakley)

- Rep. Judy Boyle (R-Midvale)

Opposed:

- House Majority Caucus Chair Dustin Manwaring (R-Pocatello)

- House Assistant Minority Leader Lauren Necochea (D-Boise)

- House Minority Caucus Chair Ned Burns (D-Bellevue)

- Rep. Rick Cheatum (R-Pocatello)

- Rep. Jeff Cornilles (R-Nampa)

- Rep. Melissa Durrant (R-Kuna)

- Rep. Stephanie Mickelsen (R-Idaho Falls)

- Rep. Jerald Raymond (R-Menan)

- Rep. Kenny Wroten (R-Nampa)

- Rep. Jon Weber (R-Rexburg)